sales tax calculator memphis tn

The Tennessee sales tax rate is currently. Tax day is a time for.

Tennessee County Clerk Registration Renewals

Integrate Vertex seamlessly to the systems you already use.

. Usually the vendor collects the sales tax from the consumer as the consumer makes a. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Standard fees and sales tax rates are listed below.

Sales taxes will be calculated as follows. City tax payments can be made by check cashiers check or money order via mail. Sales Tax State Local Sales Tax on Food.

Please contact the Shelby County Assessor for any. 064 average effective rate. Additionally cash is accepted in.

Memphis TN 975 sales tax in Shelby County 21700 for a 20000 purchase Mountain City TN 85 sales tax in Johnson County You can use our Tennessee sales tax calculator to determine. For State Use and Local Taxes use State and Local Sales Tax Calculator. The minimum combined 2022 sales tax rate for Memphis Tennessee is.

Memphis TN Sales Tax Rate Memphis TN Sales Tax Rate The current total local sales tax rate in Memphis TN is 9750. The following information is for Williamson County TN USA with a county sales tax rate of 275. TN Auto Sales Tax Calculator.

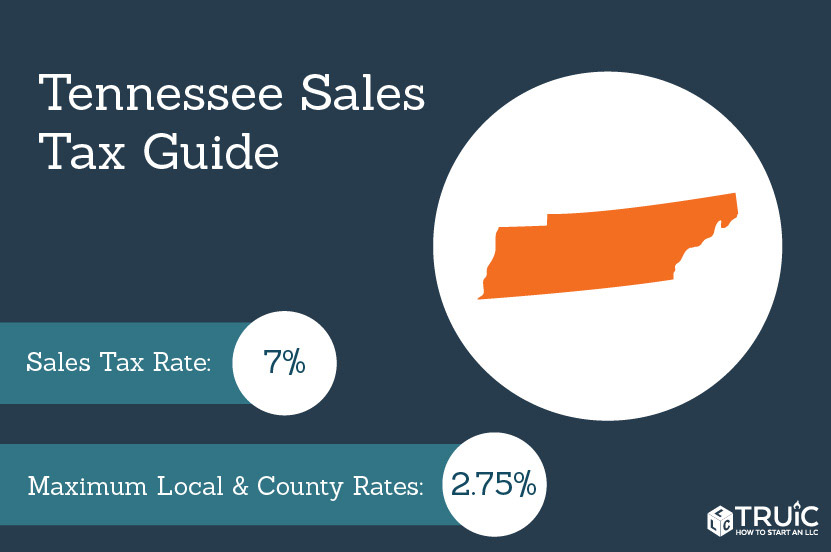

The 975 sales tax rate in memphis consists of 7 tennessee state sales tax 225. The combined rate used in this calculator 7 is the result of the Tennessee state rate 7. This is the total of state county and city sales tax rates.

Tennessee TN Sales Tax Rates by City A The state sales tax rate in Tennessee is 7000. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Using a 25000 assessment as an example.

Real property tax on median home. Tennessee has a lower state sales tax than 981 of states The county sales tax rate is. Just enter the five-digit zip.

Other counties in TN may have a higher or lower county tax rate. Call 865 215-2385 with further questions Sales Tax State Sales Tax is 7 of purchase price less total value of trade in. Multiply by the tax rate 345 divided by 100.

The December 2020 total local sales tax rate was. Local Sales Tax is. M-F 8am - 5pm.

Tax Payments Make checks payable to the City of Memphis Treasurer. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Memphis TN. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

1600 x 225 local sales tax 36 1600 x 275 Single Article tax rate 44 Total tax due on the vehicle 1851 if purchased in Tennessee. Local Tax Shelby County Unincorporated 225 of the first 1600 of the purchase price maximum of 36 Arlington - 275 of the first. 225 West Center St.

Calculate a simple single sales tax and a total based on the entered tax percentage. The sales tax is comprised of two parts a state portion and a local. 26 cents per gallon of regular gasoline 27 cents per gallon of diesel.

The 38146 Memphis Tennessee general sales tax rate is 7. Kingsport TN 37660 Phone. With local taxes the total sales tax rate is between 8500 and 9750.

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Memphis Tennessee S Sales Tax Rate Is 9 75

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Tax Filing Season 2022 What To Do Before January 24 Marca

Tennessee Income Tax Calculator Smartasset

Tennessee Sales Tax Small Business Guide Truic

Downtown Sales Tax Rate Increasing July 1 News Wsmv Com